Economic Benefits of Reforming Mobile Taxation in Pakistan

Economic Benefits of Reforming Mobile Taxation in Pakistan

Mobile sector in Pakistan has enabled almost 130 million people to be connected and have access to latest information. This will further be enhanced with the arrival of mobile broadband i-e; 3G and very recently launched 4G services. This growth of mobile industry is highly productive for both social and economic development of the country. Now we can say that mobile industry has the potential to accelerate the economic and social development of Pakistan in order to meet the objectives of PTA Vision 2025. According to GSMA Intelligence and World Bank report, 1% increase in mobile penetration can lead to a 0.28% increase in the GDP growth rate of Pakistan. A more relevant study of World Bank indicated that every 10% increase in mobile broadband penetration can accelerate the economic growth of middle-income countries (Pakistan) up to 1.38%. Therefore it is very important to understand the “Telecom Taxation in Pakistan” and how further it can be improved in order to overcome the regulatory uncertainties.

[pull_quote_left]Mobile industry has the potential to accelerate the economic and social development of Pakistan in order to realise the Vision for creating smarter societies[/pull_quote_left]

After the arrival of 3G and 4G, the future of Pakistan’s telecom industry can get brighter if the government of Pakistan reconsider its taxation policy. Still there are 60 million Pakistanis that don’t have access to mobile services. Hence, there is dire need to understand the barriers that are affecting the growth of mobile industry in general and mobile taxation in particular.

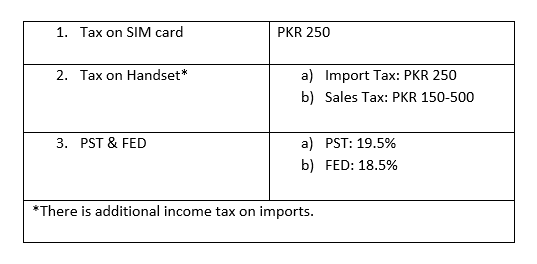

The GDP per capita of Pakistan is $1,307 (2013 est.) whereas the tax paid on a SIM card in our country is about 30% of average daily wage in Pakistan(US $ 2.46). The citizens and operators are heavily taxed that affects the affordability of mobile services in Pakistan. Following are the main taxes that are paid by every Pakistani citizen:

[pull_quote_right]Tax paid on a SIM card in our country is about 30% of average daily wage in Pakistan-GSMA[/pull_quote_right]

Telecom operators pay more than US$1.2 million taxes every year, which is actually about 30% of the overall revenue of telecom sector. Apart from these corporate taxes other taxes include:

- Custom duties and other charges on imports

- Annual regulatory fees

- Spectrum acquisition costs

The Average Revenue per User in Pakistan is one of the lowest in region and worldwide as well. Since 2006 the Foreign Direct Investment (FDI) in telecom sector has also been very low. This indicates an uncertain environment for investors even after the launch of 3G and 4G. That is why in 2013, Pakistan stood at 127th position on the Ease of Doing Business Index. Pakistan’s taxation policies are characterized by a lack of transparency and a lack of harmonization.

Taxes vary between Pakistan’s four provinces. This multitude of fees, charged differently in each province and on a variety of tax bases, makes the tax system complicated and problematic. Today, the mobile sector makes a significant contribution to Pakistani government revenues. It accounted for 7% of the $31.5 billion in tax revenue collected in 2013. However, it is important to recognize that while high taxation on the mobile sector may deliver short-term benefits for government, this comes at the cost of long-run economic growth, and is ultimately counterproductive.

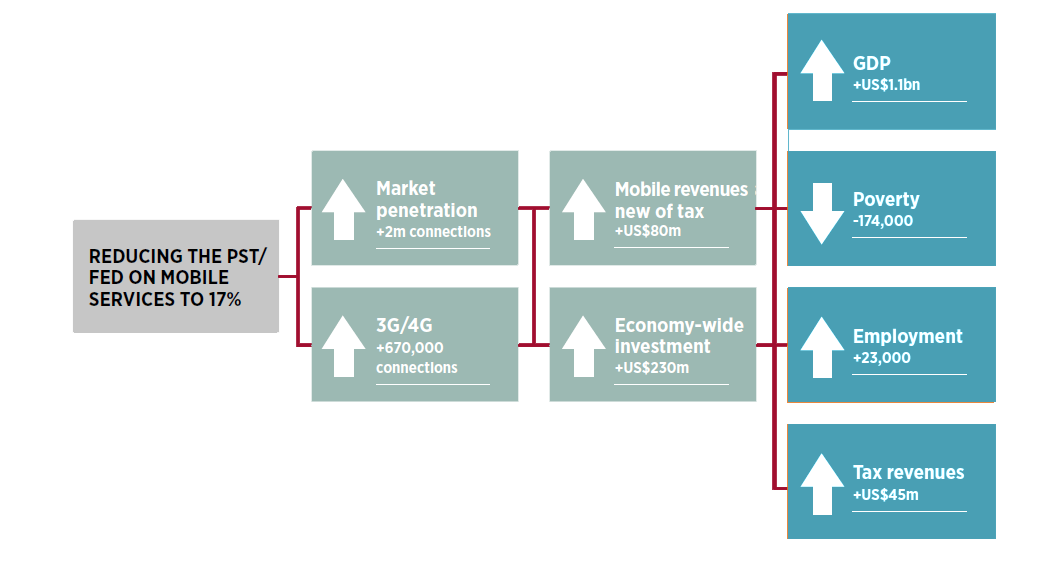

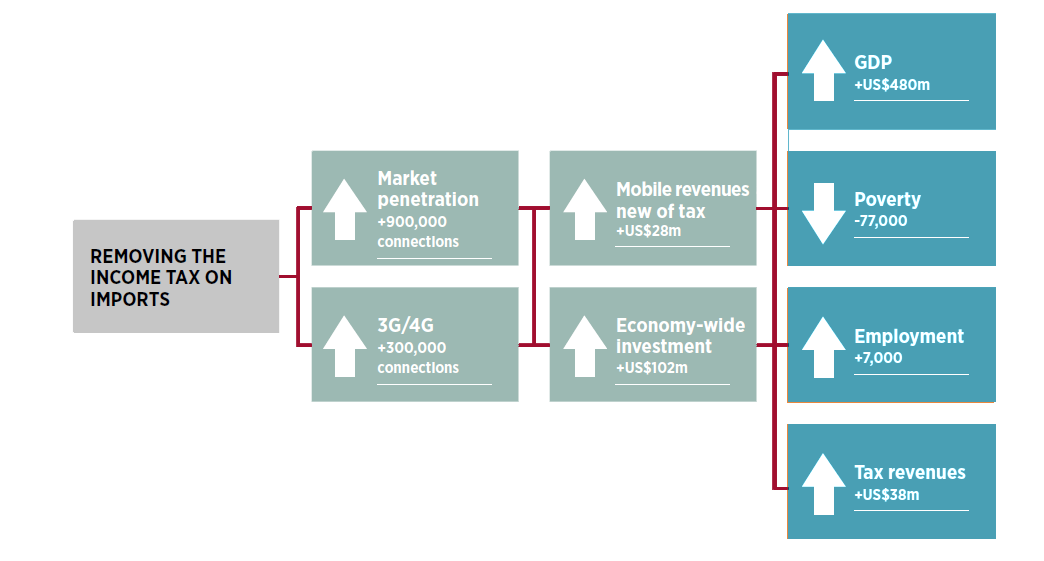

By reducing and rationalizing taxes on the mobile sector, the Pakistani government can not only increase digital and financial inclusion and economic growth, but it can also generate higher tax revenues through more efficient and broader-based taxation.

[pull_quote_left]High taxation on mobile sector may deliver short-term benefits for government but this comes at the cost of long-run economic decline, and is ultimately counterproductive[/pull_quote_left]

Furthermore, reforming mobile taxation has the potential to increase and enable the investment required to further expand mobile broadband network infrastructure.

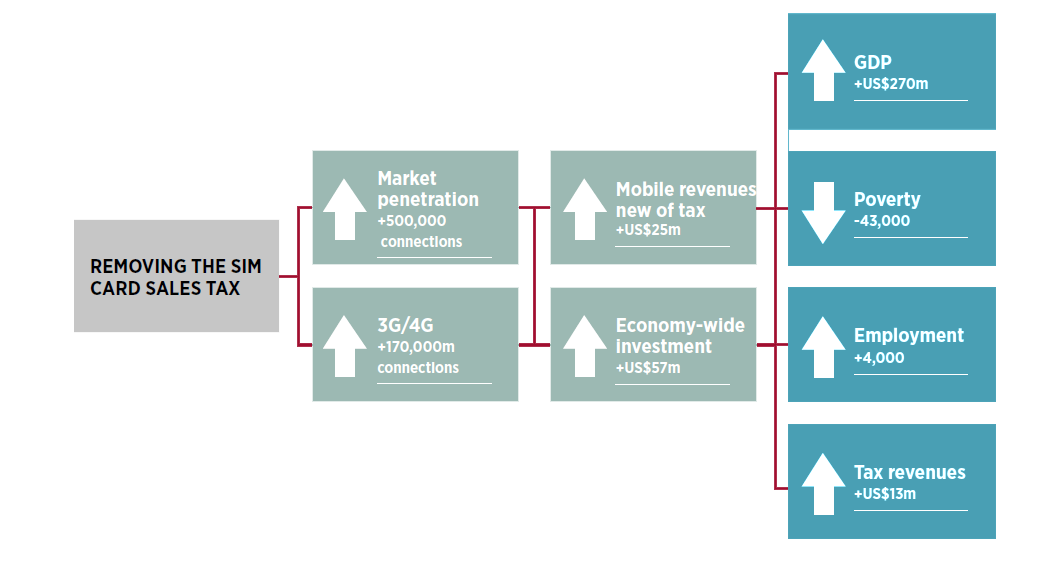

According to the GSMA Report “Digital Inclusion and Mobile Sector Taxation in Pakistan”, removing the tax could increase the number of mobile connections exponentially.

The productivity increase and growth induced by the expanding mobile sector could produce an increase of US$270 million in GDP, lifting 43,000 Pakistanis out of poverty.

While tax revenues could be lower in the short-term due to decreased tax on the mobile sector, increased GDP growth means that the government could gain revenues from more broad-based taxation; over time, the net impact on government revenues could be an increase of up to US$13 million in 2020.

3G/4G Connections Booming the Revenues: While comparing to the regional ratio, the deployment of 3G/4G in Pakistan is low; currently it is only 1% of the whole population. Presently there are about 9 Mln 3G/4G subscribers in Pakistan.

[pull_quote_right]Productivity increase and growth induced by the expanding mobile sector could produce an increase of US$270 million in GDP, lifting 43,000 Pakistanis out of poverty[/pull_quote_right]

After the launch of super-fast broadband subscribers are increasing day by day. The Government needs to provide breathing space by relaxing taxation regime rather burdening the mobile industry forcing them to act as the extension of the FBR for tax collection which will enable operators to invest in network coverage and high-quality infrastructure.

[pull_quote_left]Government needs to provide breathing space by relaxing taxation regime rather burdening the mobile industry, forcing them to act as the extension of the FBR for tax collection[/pull_quote_left]

Today, mobile networks support essential services that boost productivity and drive economic growth for the 130 million Pakistanis that have access to them. In parallel, 60 million of our fellow citizens remain unconnected. Broadening access to mobile through sector-specific tax reductions has the potential to accelerate Pakistan’s development, deliver a wide range of life-changing services and, as a result, support progress towards the smarter society.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!