Pakistan Telecom: Acquisition, Merger & Divorce

The Good, The bad and The Ugly” was an epic western movie and the wording become so popular to fit this to their own situation. Seeing changes on the telecom horizon we couldn’t resist the temptation on how it fits the telco industry where some good and some ugly events took place this year. Each year is marked with essential changes in all industries and some new companies are born while some gave out their last breath. At the end of the year we will witness a new paradigm shift in the Telecom and specifically in the mobile sector of Pakistan. Some of the fundamental changes on the visible horizon include a merger, an acquisition and a divorce on the corporate level that will change the entire scenario in the industry. The Government has also announced plan to auction the remaining spectrum from the last auction in first half of the coming year. Therefore, due to the vital importance of these likely changes we have tried to comprehend possible outcomes of each of these ventures and their impact on the entire industry.

Pakistan Telecom: Acquisition, Merger & Divorce During the Year of 2015

The Acquisition: Mobilink to Acquire Warid Telecom

While, both the companies have yet to formally announce the details but the major news of this year is that Vimpelcom the parent company of Mobilink, and the Abu Dhabi Group, a major sponsor of Warid Telecom, have agreed over in-market consolidation in the cellular sector. According to VimpelCom, the license of 4G/LTE services made Warid an attractive case for the company.

At the end of the year we will witness a new paradigm shift in the Telecom and specifically in the mobile sector of Pakistan. Some of the fundamental changes on the visible horizon include an acquisition, a merger and a divorce on the corporate level that will change the entire scenario in the industry

If these expectations turn true then there are chances that Mobilink, being a market leader in terms of subscription, is likely to shift significant load of its subscribers on Warid’s network but more importantly it may be looking more at utilizing it’s loyal postpaid customer base, network infrastructure and especially spectrum for 4G/LTE. This move could prove as a huge turnaround for both operators and will change the very paradigms of telecom sector.

The possibility of common brand is quite minimal at this stage however, even in the medium to long term we may see merger into a common brand purely because it is heavy undertaking both in terms of money and efforts to continue with two brands. Mobilink rebranded itself a couple of years back before the 3G/4G auction and invested heavily on its new outlook, so we can assume if there is a long term plan to merge the brand it could be under a single Mobilink banner. There exist a very strong argument that Warid having a very loyal postpaid subscriber base maybe a candidate of all the postpaid subscribers of both operators under that banner.

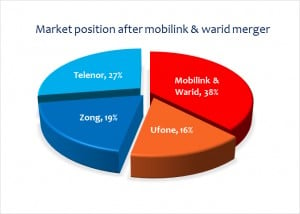

Mobilink is no doubt the market leader but with a very thin margin at present as the combine subscriber base for both will make it 38% of the total subscriber base. While, a lot of regulatory issues are tied with being a market leader it also has the benefit to offer economies of scale in tariff advantage, operational efficiency improvement of quality of service offering tied by offering additional services such as value added services, m-commerce etc. This could infact be a welcome change for the subscribers of both operators.

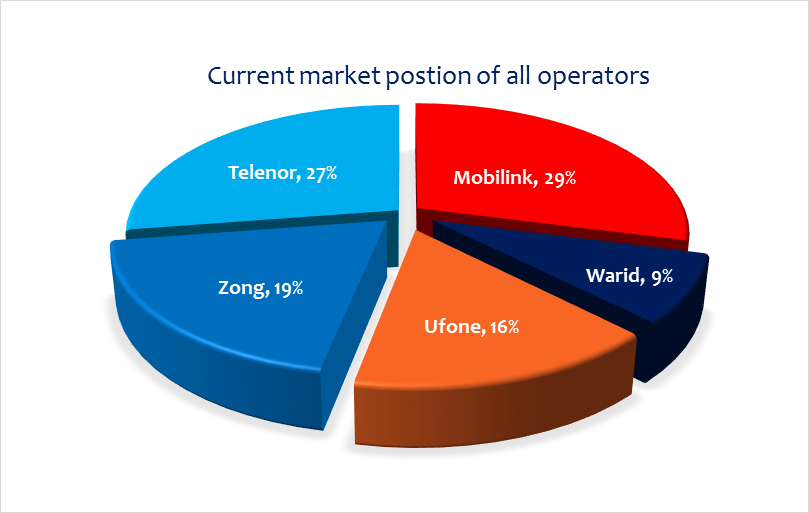

As it is evident from the graphs, presently Telenor and Mobilink are competing against each other with a very thin margin in terms of market share but once Mobilink acquires Warid, its market share will increase significantly. With increased spectrum at hand, Mobilink’s quality of service will also improve, enabling it to attract more customers. It will also position Mobilink as the strongest player in the market.

On the marketing front, Warid initially used aggressive marketing strategies to capture the market and gave tough competition to all players including Telenor that entered the market during the same time. But later on, Warid’s marketing team lost its spirits as the promotional campaigns introduced by the operator became less attractive.

Mobilink, being a market leader in terms of subscription, is likely to shift significant load of its subscribers on Warid’s network but more importantly it may be looking more at utilizing it’s loyal postpaid customer base, network infrastructure and especially spectrum for 4G/LTE

The packages and services that Warid introduced in the last few years have not been able to make any headway despite a 4G/LTE play mainly due to weak marketing and promotion. It is expected that with the merger and new flow of resources coming from the big brother Mobilink, things may change and Warid once again emerge as a strong competitor especially in the postpaid segment while maintaining its position with very focused and loyal customer base. The most important aspect besides customer acquisition is the spectrum availability. In the short term without much hassle, the added proposition for this acquisition is that both companies can use their network for roaming mode to accommodate their users. Warid can allow its current customers to use Mobilink’s 2100 MHz band and can offer 3G services for its current customer base.

While customers of Mobilink can use Warid’s 1800 MHz band for LTE services. In this case more spectrum has to be allocated to 1800 MHz band so that it can accommodate more users shifting to LTE network i.e from 3.8 MHz to 5 MHz spectrum. 900 MHz band for both operators will remain same on which 2G services are being offered. By adopting this strategy the users of both the network will enjoy different flavors of technology.

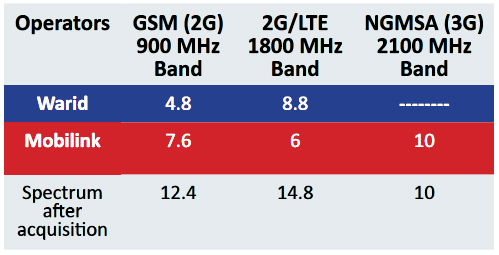

In the long term we can clearly see that Mobilink-Warid acquisition will take the lead in terms of spectrum allocation. There can be many possibilities and prospects regarding the utilization of the merged spectrum. As of now Warid has 4.8 MHz spectrum in 900 MHz band and 8.8 MHz in 1800 MHz band, while there is no spectrum available to Warid in 2100 MHz Band.

Warid can allow its current customers to use Mobilink’s 2100 MHz band to offer 3G services for its current customer base. While customers of Mobilink can use Warid’s 1800 MHz band for LTE services. In this case more spectrum has to be allocated to 1800 MHz band so that it can accommodate more users shifting to LTE network i.e from 3.8 MHz to 5 MHz spectrum

Warid is using 900 MHz band for 2G related services, whereas a part of 1800 MHz band mostly 3.8 Mhz is used for 4G services. On the other hand, Mobilink has 7.6 MHz in 900 MHz band (2G), 6 MHz in 1800 MHz band (2G) and 10 MHz in 2100 MHz band (3G) spectrum. Both 900 MHz and 1800 MHz band spectrum are used for 2G services by Mobilink while 2100 MHz band is being used for 3G services. It is important to note that since all mobile licenses are technology neutral and anyone can use allocated spectrum for any type of service subject to regulatory approval but it is mostly dictated by the overall technology and commercial eco-system.

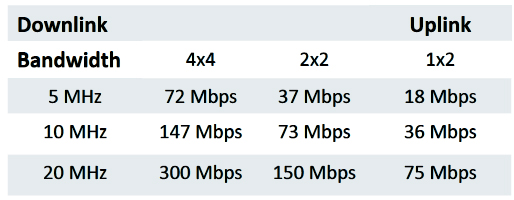

The combined Mobilink-Warid network will have 12.4 MHz spectrum in 900 MHz band, 14.8 MHz spectrum in 1800 MHz band and 10 MHz spectrum in 2100 MHz band. One of the best possibility is that Mobilink can use its 10 MHz spectrum from 14.8 MHz in 1800 MHz band for LTE data services while remaining 4.8 MHz can still be used for 2G services. This will not only improve data speeds but will also place Mobilink in the list of operators that provide LTE services. The chart below shows the downlink and uplink speeds that can be achieved using Multiple-Input and Multiple-Output (MIMO) technology in LTE.

By combining the 2G spectrums of both Warid and Mobilink, they will have 12.4 MHz spectrum in 900 MHz band which can be mainly used for existing 2G services until probably such time that it is feasible to deploy VoLTE (Voice over LTE) in future. Since a large part of 1800 MHz band can be used for the LTE services, the voice traffic can be shifted to leftover spectrum in 1800 MHz and 900MHz band. This strategy can accommodate more users on the network while maintaining good quality of service for both voice and data and will reduce congestions. As of now both 900 MHz and 1800MHz band of Mobilink is used for 2G services.

2100 MHz spectrum is considered to be a harmonized band for 3G Technology (although it is mostly being used for LTE now) and is used for providing 3G services by Mobilink that will remain the prime choice for the merged company for proving 3G services specially as Warid does not hold any spectrum in 2100 MHz.

Although, the atmosphere for remaining competitors will become tougher and they will not only have to devise aggressive strategies but will also have to come up with stronger plan for the future spectrum auction to retain their market share. The possibility of various combination of spectrum use puts Mobilink in a more comfortable zone viz-a-viz the upcoming spectrum auction even in the absence of acquisition of additional spectrum from PTA, as it may be able to survive by having network and services available for all types of services i.e. 2G, 3G and 4G.

In terms of Infrastructure use, Warid has used Ericsson from day one, whereas Mobilink uses Huawei and ZTE. Ericsson being a European brand provides very reliable and state of the art infrastructure services which enables operators to offer enhanced quality mobile services, a major reason for Warid exceptional quality of service and loyal customer base. Huawei has lately improved their services but still they have a long way to go before they could touch the quality benchmark of Ericsson. The strategy again could be shifting high value postpaid customer to the Ericsson network whereas the rest of them on the Huawei/ZTE network. It is certainly easier said than done and they would need to do lot of network planning and optimization before they could optimally use the network in a much harmonized fashion.

Mobilink has quite recently made some major changes in its own management by getting rid of fat in middle and upper tiers of hierarchy. Once the acquisition is done there is a possibility that Mobilink being the buying party will call the shots and the possibility of redundancy and eventual layoff may happen in Warid work force.

The Merger: PTCL & Ufone to Merge Management & Operations

Another interesting likely corporate deal to conclude is the merger of Pakistan Telecommunication Company Limited (PTCL), the leading landline and fixed Wireless Telecommunication Company in Pakistan and Ufone (100% owned subsidiary of PTCL) as they have finally decided to merge their management and operations. This merger or integration as they call it is expected to happen by the end of this year.

Ufone was the 4th mobile operator to enter Pakistan telecom market and for a long time it remained the 2nd largest mobile network of Pakistan. However, its performance has deteriorated for last couple of years and while it slipped to 4th position in terms of customer base

While, everyone knows that PTCL is a fixed-line whereas Ufone is wireless operator but once both operators merge their business, there is a likelihood to operate under a single banner. Brand name is a very important element of an organization’s goodwill, so if both companies come under a single brand name, it may help both companies in many ways. Etisalat, the shareholder partner that has management control over the privatized PTCL & its subsidiaries operates under the same principle in other countries, where they have operations. The brand equity of Ufone however is much better than PTCL due to historic reasons and it may help if they come under the Ufone banner rather PTCL.

The move for merger probably is prompted by the downward trend for the companies. Ufone was the 4th mobile operator to enter Pakistan telecom market and for a long time it remained the 2nd largest mobile network of Pakistan and the reason why Etisalat probably ventured to buy PTCL in the first place. However, its performance has deteriorated for last couple of years and while it slipped to 4th position in terms of customer base, it has also quite recently for the first time announced a loss of almost Rs. 5 billion just in 9 Months which is probably more worrying for the shareholders.

This not only effects Ufone but also the profits of PTCL Group in general whose nine months profit ending September 2015, were Rs. 7.9 billion down from Rs. 8.7 billion in same period last year. Once the management and operations of both companies are merged and consolidated strategies are built for both business, it is likely to arrest the downward trend in profit margin hence improving the quality of service and financial performance of both companies. But even if this is not the case, merger of management and operations will surely bring some major changes in the systems and workings of both players.

The move may not have any drastic market share changes for the mobile industry as is the case with Mobilink and Warid but there would be definitely more aggressive bundling of services. This was already being done at a very low level but we may see this phenomenon being accelerated or even being marketed under a single banner as we indicated earlier. In order to better grab the attention of customers both can start combined promotion providing value added services. PTCL and Ufone together, will have a wide range of product spectrum from landline to mobile through which both can use to offer various services. This is an advantage that no other operator has in Pakistan. Ufone is already offering special packages and call rates on PTCL numbers, after this merger they can introduce similar kinds of offers to attract more users on their networks. Combined used of the distribution channels may also bring dividends.

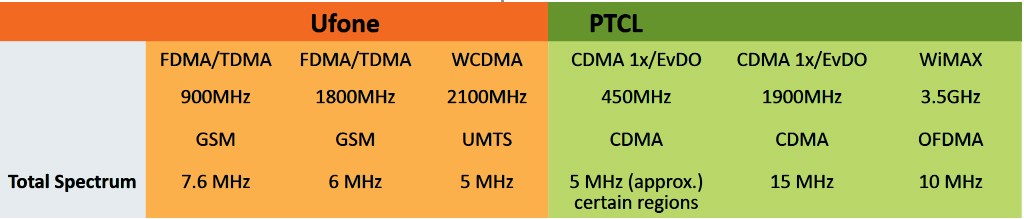

Another major area besides financials consideration will be the spectrum synergy, consolidation or the use of Spectrum. Ufone was not able to secure any meaningful spectrum in the last spectrum auction and its Data services have been suffering from quality of service standpoint as compared with that being offered by other operators. This gap will continue to increase as more subscribers are added or more Ufone customers shift from voice to Data resulting in further degradation of quality of service consequently impacting customer retention and expansion-bottom line being negative effect on financial indicators.

The merged operation could enable Ufone to use PTCL’s existing spectrum to introduce LTE in market. Their certainly will be a debate around the use of the 1900 Mhz spectrum for mobile services from a regulatory standpoint. Primarily, the 1900 Mhz spectrum also known as the PCS band was allocated for WLL services and the mobile industry had in the past taken a very tough position on the use of the spectrum for mobile that eventually saw the demise of almost all WLL operators except PTCL. It is a very interesting proposition as now a mobile company maybe looking at the spectrum to be used under the mobile license. Technically, the PCS band for LTE is used mostly in USA and there maybe some issue with device availability in the lower or affordable range that supports this spectrum.

Anyhow, setting aside the regulatory debate the merged company shall definitely have a considerable spectrum to strategize there technology preference. Most importantly they will have 15 Mhz of spectrum in 1900 Mhz for Data services to compete in the market.

Originally, PTCL only had 5 Mhz but they very wisely acquired DVCOM, a Wireless Local Loop company that has been inactive for past many years and also had agreement with WorldCall for using their Spectrum/Infrastructure accumulating a good amount of spectrum that is the life line for any wireless company.

PTCL-Ufone use of the combined spectrum of 1900 Mhz could be quite useful but that does not take away the importance of acquiring the more harmonized bands for 3G/4G that Etisalat will have to look more seriously in the upcoming auction of 850 Mhz and 1800 Mhz band being planned for early next year

There also were discussion with other WLL operators on buyout. The PTCL move besides for its own good may help in making better use of the spectrum that remained under-utilized. While, PTCL-Ufone use of the combined spectrum of 1900 Mhz could be quite useful but that does not take away the importance of acquiring the more harmonized bands for 3G/4G that Etisalat will have to look more seriously in the upcoming auction of 850 Mhz and 1800 Mhz band being planned for early next year. Ufone is presently using only 5 MHz for 3G services so in order to better utilize the spectrum at hand, Ufone will have to take some drastic steps to level up in the telecom market for not only attracting maximum number of users but also arrest the declining retention rate.

The merged company could make use of their infrastructure and may have to work hard in planning the use of each other infrastructure and most important would be to ensure that there exist low cost devices that could support 1900 MHz spectrum.

The devices in Pakistan market especially on Ufone may not be 1900 Mhz supported but then the argument may also hold good that all the high-end devices do support 1900 Mhz spectrum and the initial roamers or use of the LTE network would be the high end customers.

Ufone is very well-known for its creative advertisements, which is the hall mark of their marketing strategy. The company has won numerous awards over the years for its innovative and ingenious TVCs whereas PTCL’s advertisements are only below average. When this merger is successfully completed, PTCL marketing team can take benefit from Ufone’s creative team to improve its marketing and advertisement techniques.

Now that Telenor Group has separated itself from Vimplecom, we can expect major changes in its business strategy. It has already announced changes in its management team that it said would better represent group’s international business

After the merger of management of both companies, while one expect that best of both companies to work in harmony but we often see situations where friction happen from new roles. Therefore, the core of this merger will be to work hard for organizational harmonization and make strategies that are beneficial to both organizations. It is also speculated that after this merger employees of one organization will be able to switch to other which can be considered a good move as both companies will be able to make use of wider talent pool.

Divorce: Telenor Group Parts Ways with Vimplecom

IK and Reham khan wedding and their eventful divorce was the talk of the town this entire year on the political and social front. Similar to that was the marriage and finally divorce of the world’s biggest telco giants that had their roots numerous countries including Pakistan. Telenor Group joined Vimplecom in 2009 and is the second largest shareholder with 33% economic rights and 43% voting rights. Telenor in which 54% shares are held by Norwegian government has long been in open conflict with Vimplecom’s other major shareholder, Russian billionaire Mikhail Fridman, over control of company and its strategy, which became so severe that diplomatic issues between Osla and Moscow roused from it. Vimplecom is also under investigation by authorities in USA and Netherlands over the bribe allegations it paid to access the Uzbek market. Due to these allegations Telenor’s Group Chief Executive also stepped down from Vimplcom’s board. After all this, Telenor Group finally decided to put its entire 33% stake in Vimplecom for sale, valued at some $2.4 billion.

Telenor Group’s biggest concern has been that its minority position in strategy development and decision making process. Now that Telenor Group has separated itself from Vimplecom, we can expect major changes in its business strategy. It has already announced changes in its management team that it said would better represent group’s international business. According to the new management setup, all 13 markets in which company operates will be represented at management board level. This will enable all business subsidiaries to facilitate strategy development for each division and will also ensure faster execution of overall group strategies. This breakup of partnership has created an interesting situation in Pakistani market where subsidiaries of both groups are working i-e Mobilink and Telenor. It was widely speculated that Telenor Pakistan took a back seat on the Pakistan spectrum acquisition last year as they were planning to merge networks in Pakistan. If that had any iota of truth then Telenor Pakistan should clearly be in trouble specially going ahead. Also, now that both groups have parted ways, we can expect major changes in strategies of both operators in Pakistan. Telenor Group is already quite aggressive in its approach and now it shall focus all its attention to its core business and will try to penetrate the market with even greater force in all markets including Pakistan. The major strategy after the break-up would be to acquire additional spectrum so that it can pursue its growth strategies that are focused on Data Services. With Warid now being acquired by Mobilink it leaves not much options for Telenor but to take the Spectrum being auction by Government otherwise it would seriously jeopardize its market position and growth strategies.

The major strategy for Telenor after the break-up would be to acquire additional spectrum so that it can pursue its growth strategies that are focused on Data Services in Pakistan

Vimplecom on the other hand is facing heavy losses with first-quarter sales plunged 30 percent. To overcome its net debt by $2.4 billion it has sold majority of stakes in Algerian Jjezzy unit and disposed off Italian Wireless towers. However, its Pakistan strategy is on expansion as we discussed earlier that it has already negotiated acquisition with Abu Dhabi Group for Warid Telecom. Meaning there by, Vimplecom considers Pakistan as its one of the major market and sees great potential for the future. So all in all both groups are quite serious about Pakistan as it is one of the fastest growing mobile market in the region. While we can make projections but only time will tell that which group will emerged as more successful competitor after the divorce especially in Pakistan.

2015 has proved to be the year of acquisition, mergers and divorce and will lead to a totally changed telecom environment making it tougher and more competitive

In order to catch up with the developed world, aggressive business and technology development strategies are needed to be adopted by the telecom sector of Pakistan as it is the backbone of the economy. 2015 has proved to be the year of acquisition, mergers and divorce and will lead to a totally changed telecom environment making it tougher and more competitive. With increased competition, there will be more advantages for consumers as they will be able to use advanced and affordable technology. These corporate changes will surely increase cellular penetration in the country and eventually bring Pakistan among the highly connected mobile broadband regions in the world.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!