Mobile Phone Taxation Misinterpreted: Exemption of Regulatory Duty to offset Taxation

The perception being created prominently by media that taxes have been doubled is an exaggeration with reference to the updates of budget 2015-16. We are witnessing the hype created that mobile phone prices have been increased dramatically by the recently imposed taxes. However, if we apply compare and contrast strategy to this situation, we will come to know that the real picture is not that much scary. The following fundamental points have been misinterpreted by some industry professionals and tech bloggers:

- While, previously tax on mobiles and regulatory duties were treated separately. Whereas, now, only sales tax would be charged on import of mobile phones and the regulatory duty had been abolished; this should simplify things for both the government and the tax payers.

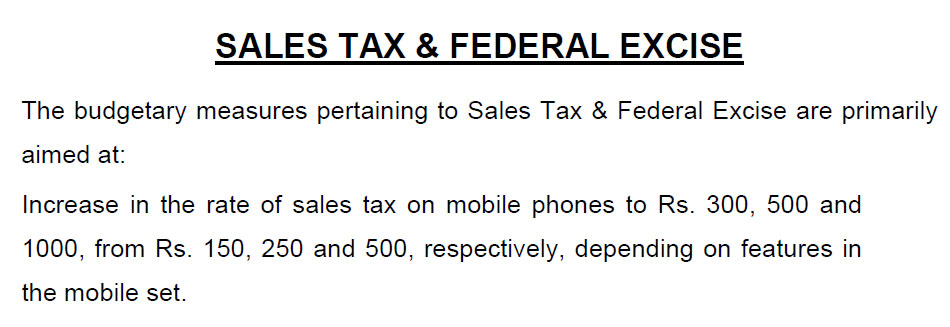

It is true that the Government of Pakistan has doubled the taxes on mobile phones. As a result, General Sales Tax (GST) that was earlier Rs. 150, 250 and 500 on lower, middle, and higher end mobile phones respectively will now be Rs. 300, 500 and 1,000 for the same categories of handsets. Whereas on the other hand, Minister Ishaq Dar announced to cancel Rs. 200 import duty on every mobile phone that government had imposed few months back.

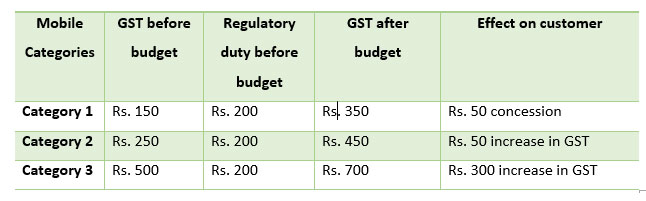

Comparison of Previous & Current Mobile Taxation:

- An interesting point to note is that the purchasers of 1st category of low priced mobile sets will now get a concession of Rs. 50 as they used to pay Rs. 350 on their import, that included Rs. 150 sale tax plus Rs. 200 regulatory duty but now they would have to pay only sales tax of Rs. 300 instead of Rs. 350 combined.

- Similarly, the sales tax on import of 2nd category of mobile phones had been fixed at Rs. 500 against total Rs. 450 charges (Rs. 250 sales tax and Rs. 200 regulatory duty).

- On the 3rd category of mobile phones, Rs. 700 was previously charged, including Rs. 500 sales tax and Rs. 200 regulatory duty, while now the buyers would have to pay sales tax only of Rs. 1,000. This probably is the category of high end phones that will have negligible impact.

Source: Federal Board of Revenue (Budget 2015-16)

The Finance Minister Ishaq Dar further explained in post budget conference that:

[pull_quote_center]“Budget 2015-16 is for the poor people of Pakistan and increase in the taxes on mobile phones is mainly targeting high end smartphones whereas the relief of waiver on import duty will pass on to poor people who can only afford a cheap mobile phone.”[/pull_quote_center]

While, in actual terms the recent re-adjustment has little or no effect rather may be a better step however the overall duties and taxes (that were in place even before the budget) does impact the mobile industry at large. Marketing Head of Mobile Phones, Fraz Khan, at Huawei Pakistan commented on the situation as:

[pull_quote_center]“Government should rationalize the entire tax structure on mobile phone industry for the benefit of all the stakeholders. Rise in GST will tempt mobile phone sellers to further rely on existing grey channel that will eventually increase unregistered sales of mobile phones.”[/pull_quote_center]

An official of a leading mobile phone distribution company told:

“A total of more than 11% is charged at the time of import of mobile phones in shape of various duties and taxes including Freight, Fixed Sales Tax, Advance Sales Tax and WHT. Government has doubled fixed sales tax which will only hurt the buyer of lower end mobile phones in Pakistan.”

The official also added:

[pull_quote_center]“In actual, the duty structure for cheap mobile phones goes as high as 25% in some cases. Government of Pakistan needs to ease this structure for broadening the mobile handset industry tax-base which will translate into more revenues for the government.”[/pull_quote_center]

In a net shell, we can conclude that after paying all taxes and duties, now consumer will get:

- A mobile phone of worth Rs. 2,000 now at Rs. 2,550 (Rs. 300 fixed GST)

- A mobile phone of worth Rs. 61,000 now at Rs. 70,000 (Rs. 1000 fixed GST)

Analyzing the previous year results and imports, unfortunately mobile phone import has shown a decline in the second half of FY 2014-15. The monthly import of mobile phones were recorded less than 1.8 million in the month of April 2015, a figure which is 30% lower than the average monthly imports of mobile phones in the year 2014.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!

The current government is having huge Taxes imposed on people but the economy is also boosting from their tax collection schemes for mobile phone and other stuff.

a good helping article as we are launching out our brand of smartphones in pakistan as well now and looking for distributors so lately we had been in a big argument with dealers on this import duty thing, now picture is very much cleared.

I want to know that now any objection on 2nd hand is not allowed in Pakistan import from other countries?

Govt should take return taxes on mobile.

http://www.mobile-phone.pk